Why you need to understand your credit score

Disclosure: Thank you Capital One® for sponsoring this post! All opinions are my own, and were not directed by Capital One. To learn more about CreditWise® from Capital One®, visit: https://creditwise.capitalone.com.

I could not believe it when my sister, Emily, told me that she wanted to buy her first home. I remember when we used to play with our Barbie Dreamhouse and build forts together in the backyard! I was so excited for her, as this is such a major life milestone, but when she started explaining the financial process, I realized I had no idea how competitive the housing market is and how important it is to have a strong line of credit.

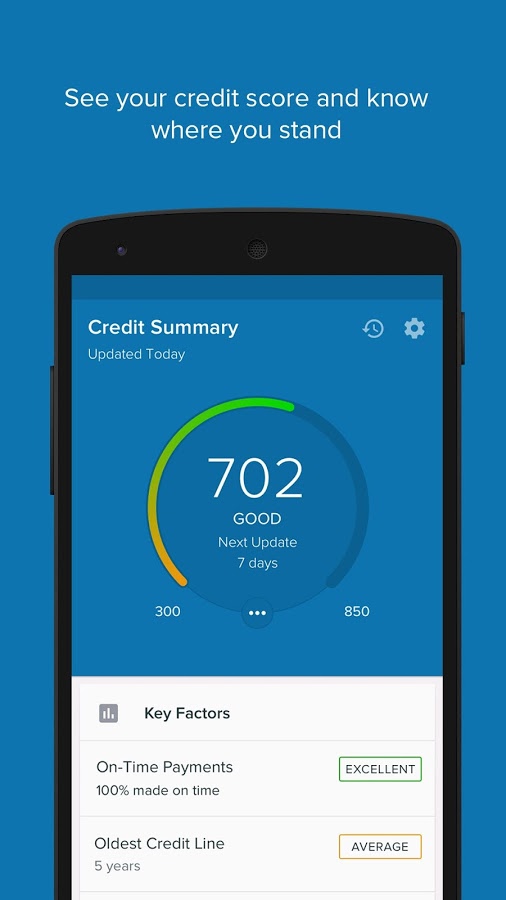

Buying a home is such a huge investment and banks want to make sure that the buyer has not only the necessary capital for a down payment, but also good financial practices of paying on time and staying within their financial means. When my sister and her husband applied for a mortgage, one of the first things the banker did was run a credit check. Emily, like most young people, knew that a credit score was important, but not what comprised it. That is when I directed her to the CreditWise® app from Capital One®. I like CreditWise because it is both easily accessible and straightforward, so that the average consumer can understand and use it in the real world.

I showed Emily how CreditWise provides instant access to your credit score right on your smartphone. Plus, what I find most interesting, is that it shows the components that actually make up your score. These include items such as your “on time” payment history, how much credit you are using, your oldest credit line and so on. The app even has a credit simulator, which is like a financial crystal ball that can tell you how positive or negative financial decisions could affect your score in the future. So, for example, the credit simulator could run the numbers to determine whether paying your bills on time for the next year could improve your credit score.

Credit scores were definitely not the kind of thing that we thought about as kids growing up. But I realize now that, as we reach adulthood, we really have to start caring about a secure financial future. I hope that the financial tips that I shared with Emily help her qualify for a loan to get a big house with an extra bedroom, so I can stay whenever I want.

Click here to download the free CreditWise app and see how you can strengthen or improve your credit score.